Convex financial instruments

New ways to stabilise institutional portfolios

Institutional investors today face a structural dilemma: rising interest rate volatility, increasing geopolitical risks, and a high level of correlation between risk and safe-haven assets have substantially eaten into the diversification efficiency of traditional 60/40 portfolios. In this environment, convex financial instruments such as options and variance swaps are gaining in importance. They facilitate a systematic reduction in tail risk, the smoothing of return profiles and, ideally, an improvement in risk-adjusted returns over the entire investment cycle. Please note: investing in securities involves both opportunities and risks.

The non-linearity of the payoff profiles of convex instruments implies limited losses on small movements but potentially unlimited gains on large market movements.

Convexity as risk architecture

In portfolio theory, convexity refers to the non-linearity of an instrument's payoff structure. It allows for a disproportionate response to large market movements – a key advantage in periods of heightened uncertainty. Unlike linear investments (e.g. equities, bonds, swaps), convex positions generate an asymmetric exposure structure, which is particularly valuable in times of stress.

For institutional portfolios, convexity can be used strategically in the following ways:

- Reduction of expected shortfall and volatility.

- Increase in geometric return (CAGR) through lower drawdowns.

- Securing reinvestment capacity after periods of market stress.

Options as asymmetric diversifier

Options are the simplest form of convex instruments. Their effect depends less on market timing than on consistent allocation and structuring. Implied volatility, which usually follows a mean reversion process, plays a particularly important role here. Therefore, buying optionality in times of low volatility should be promising in the long term.

Although the premium tends to reduce returns in periods of sideways markets, it delivers disproportionately high returns in turbulent market phases, which is exactly what is needed in a portfolio context. Options are therefore ideal as a strategic overlay component to benefit from the typically negative correlation between volatility and risk assets.

Long volatility as insurance component

A long-variance overlay acts like dynamic insurance: in periods of stress, realised variance increases disproportionately, generating positive payoffs. These cash flows can be used to rebuild risky positions in a countercyclical manner. In addition, the liquidity position improves in phases when traditional diversifiers (e.g. government bonds) fail.

Strategic integration into the institutional portfolio

Institutional investors typically implement convex strategies not as a core component of their asset allocation, but as an overlay — that is, as an additional, rule-based risk management component that operates in parallel to the core portfolio. This structure keeps the core portfolio stable while allowing targeted hedging and return optimisation mechanisms to be implemented.

Allocation and magnitude

- The overlay portion might account for approximately 5% to 10% of the total portfolio. This leaves sufficient capital in the core portfolio to maintain the strategic asset allocation (e.g. SAA targets) and benchmark roles.

- In times of crisis or when volatility levels rise sharply, this ratio may be temporarily increased, e.g. by activating a risk budget or through tactical reinsurance (tail hedge).

Convexity as strategic axis of modern asset allocation

In a macroeconomic environment in which traditional diversification effects are diminishing, convexity is gaining strategic relevance. The combined use of options and variance swaps offers institutional investors the opportunity to

- control structural risks,

- limit drawdowns,

- and still achieve stable risk-adjusted returns.

In the long term, this will give rise to a new form of portfolio construction: less linear, more resilient to regime changes, and better suited to a world in which risk absorption has become more important than pure return maximisation.

I-AM Global Macro Convexity Fund: a case study of strategic convexity

With the I-AM Global Macro Convexity fund, Erste Asset Management offers a building block for covering the topic of convexity in a resource-efficient manner with a team of experts who come with many years of experience in derivatives. The fund invests globally in equity, interest rate, currency, and credit markets, primarily through the use of tailor-made derivatives (OTC) and exchange-traded products.

The fund is particularly well-suited for investors who are looking for robust, uncorrelated sources of return in a volatile market environment and at the same time want to hedge their portfolio against extreme risks. Please note: investing in securities also involves risks.

Sample product: variance swap

Highly convex variance swaps are a frequently used instrument in the I-AM Global Macro Convexity fund. These OTC derivatives, which are particularly widespread in the equity sector, offer quadratic exposure to volatility, i.e. the variance of the underlying, in contrast to options or linear volatility swaps.

Example (variance swap vs. volatility swap)

- Strike 20% or (20%)^2, respectively

- Vega Notional 100K (The position reacts with approximately 100,000 monetary units in profit or loss to a 1 percentage-point change in volatility.)

- The variance swap always outperforms the volatility swap, especially in cases of extreme levels of realised volatility.

- Arbitrage considerations mean that the variance swap MUST have a higher break-even point ('strike') than a volatility swap.

In the example, a theoretical maximum loss of 1 million (at a realised volatility of zero) is offset by an unlimited profit potential of several million. In practice, of course, the maximum loss is almost never reached; profits arise in the event of large daily movements both from the high realised variance and from the typically sharp rise in implied volatility for the remaining term.

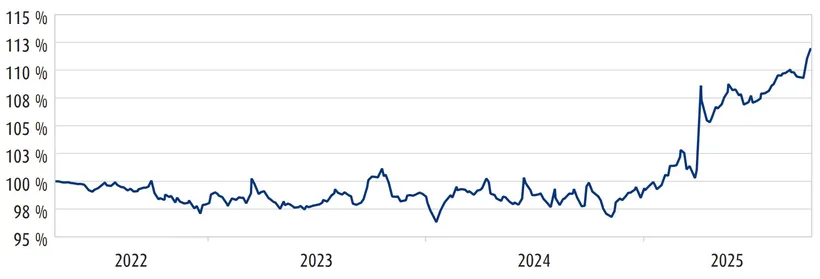

The combination of risky assets (e.g. equities or carry trades) and variance swaps in the right proportion allows the portfolio to drift positively in calm market phases. When markets become highly volatile, the convexity comes into full effect and can lead to exceptional results, as can be clearly seen in the chart for April of this year (Liberation Day).

Past performance is not indicative of future value development.

Source: Cyberfinancials Datenkommunikation GmbH, reference period 19 April 2022 to 10 October 2025, data as of 10 October 2025

Performance since fund launch. Every capital investment involves risk. Prices may rise as well as fall. The performance calculation does not allow for load or redemption fees and is based on the BVI method, which takes into account all costs incurred at fund level and assumes that any distributions are reinvested. Based on an investment amount of EUR 1,000, the maximum front-end load and a back-end load (if applicable, see master data). It does not take into account any other individual costs incurred by investors, such as depositary account management fees.

For explanations of technical terms, please visit our Fund Glossary.

Disclaimer

This document is an advertisement. Please refer to the prospectus of the UCITS or to the Information for Investors pursuant to Art 21 AIFMG of the alternative investment fund and the Key Information Document before making any final investment decisions. Unless indicated otherwise, source: Erste Asset Management GmbH. Our languages of communication are German and English.

The prospectus for UCITS (including any amendments) is published in accordance with the provisions of the InvFG 2011 in the currently amended version. Information for Investors pursuant to Art 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in connection with the InvFG 2011. The fund prospectus, Information for Investors pursuant to Art 21 AIFMG, and the Key Information Document can be viewed in their latest versions at the web site www.erste-am.com within the section mandatory publications or obtained in their latest versions free of charge from the domicile of the management company and the domicile of the custodian bank. The exact date of the most recent publication of the fund prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the Key Information Document are available, and any additional locations where the documents can be obtained can be viewed on the web site www.erste-am.com. A summary of investor rights is available in German and English on the website www.erste-am.com/investor-rights as well as at the domicile of the management company.

The management company can decide to revoke the arrangements it has made for the distribution of unit certificates abroad, taking into account the regulatory requirements.

Detailed information on the risks potentially associated with the investment can be found in the fund prospectus or Information for investors pursuant to Art 21 AIFMG of the respective fund. If the fund currency is a currency other than the investor's home currency, changes in the corresponding exchange rate may have a positive or negative impact on the value of his investment and the amount of the costs incurred in the fund - converted into his home currency.

Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite. Past performance is not a reliable indicator of the future performance of a fund.